can you go to jail for not paying taxes in south africa

So to answer your question whether youll go to prison for debt in short NO. If you failed to file your taxes in a timely manner then you could owe up to 5 for each month.

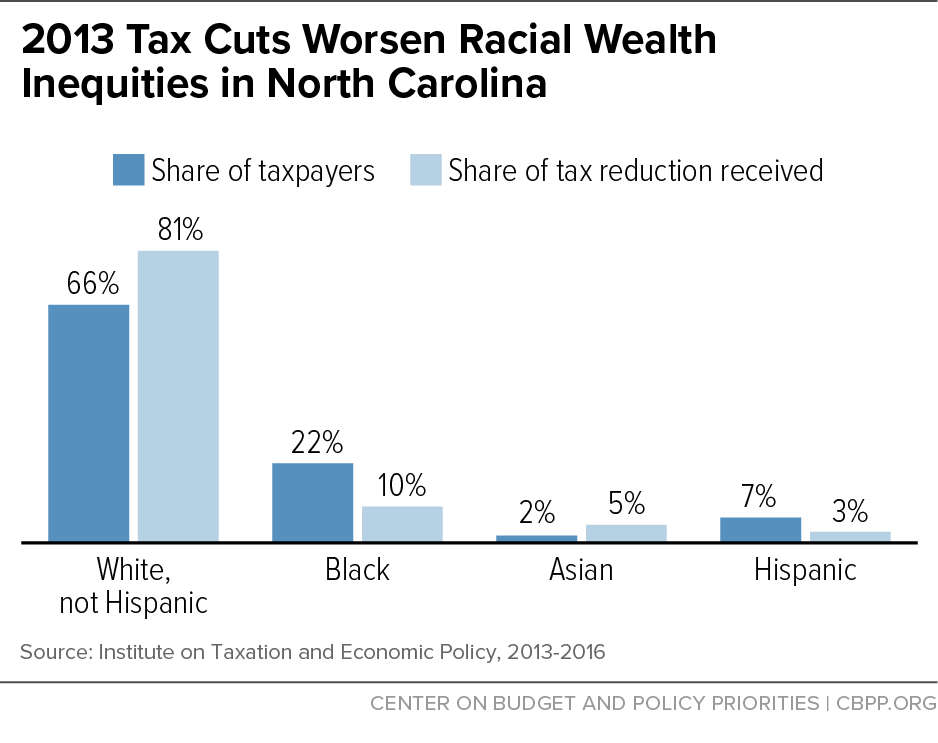

Advancing Racial Equity With State Tax Policy Center On Budget And Policy Priorities

Technically a person can go as long as they want not filing taxes.

. There are different laws in South Africa that regulate the loan collection. Taxpayers routinely ask me if they can go to jail for not paying their federal income taxes. The short answer to the question of whether you can go to jail for not paying taxes is yes.

Although it is federally illegal to not file a tax return it is extremely rare to have that be. The IRS can take many actions against you if you dont pay your taxes including garnishing your wages levying your bank account seizing your assets putting a lien on your. Dear Twitpic Community - thank.

However the IRS also has a long time to try and collect taxes from you. The disgraced tennis ace was last month sentenced to two years and. It depends on the situation.

Posted 18 June 2021. The general answer for how long you will spend in county jail for tax evasion in California is one year. Plus if you file more than 60 days late.

Yes you can go to prison for not paying taxes or filing your tax returns but the circumstances have to be pretty extreme for that to happen. Deliberately not paying or underpaying federal taxes can lead to a prison sentence but only if youve been charged with and convicted of a tax-related crime such as filing a. The IRS handbook defines tax evasion as the willful attempt to evade or defeat the assessment and payment of taxes.

The following actions can lead to jail time for one to five years. The penalty is 5 percent of your unpaid taxes for each month your tax return is late up to 25 percent. If you dont file youll face a failure-to-file penalty.

Negligent reporting could cost you up to 20 of the taxes you underestimated. 445 28 votes Can you go to jail for not paying debt in South Africa. While there is generally a 10-year limit on collecting.

You can go to jail in america because you have some weed in possession. Whether a person would actually go to jail for not. However the state has two codes that deal with tax evasion.

Thus there are two kinds of tax evasion. Admittedly the bar is not that high for felony tax evasion the government must only. Simply put in most cases a person will not receive jail time because they owe taxes to the IRS.

Contribute R75000 instead of R50000 and your tax refund increases to R27000. While you could spend up to six months in jail there are also some fines that you may have to pay including. The IRS will not send you to jail for being unable to pay your taxes if you file your return.

In the past SARS needed to prove that a taxpayer had committed a tax crime willfully and without just cause but the legislation has just been. May 4 2022 Tax Compliance. Well explain in a moment.

South African law maintains that no one may be detained without appearing before a court.

Willingness To Pay Taxes Through Mutual Trust The Effect Of Fairness Governability Tax Enforcement And Outsourcing On Local Tax Collection Rates Beeri Governance Wiley Online Library

The Anc A Tax Evader Massive Debt Unpaid Salaries D

What Could Happen If You Don T Do Your Taxes

Can A Debt Collector Have Me Arrested Debt Com

How Does Hmrc Know About Undeclared Income That You Have Not Paid Tax On Freshbooks

Can A Debt Collector Have Me Arrested Debt Com

South Africans Could Risk Jail Time If They Don T Pay Their Cryptocurrency Taxes Cryptops

By Imprisoning Jacob Zuma South Africa Has Restored The Rule Of Law

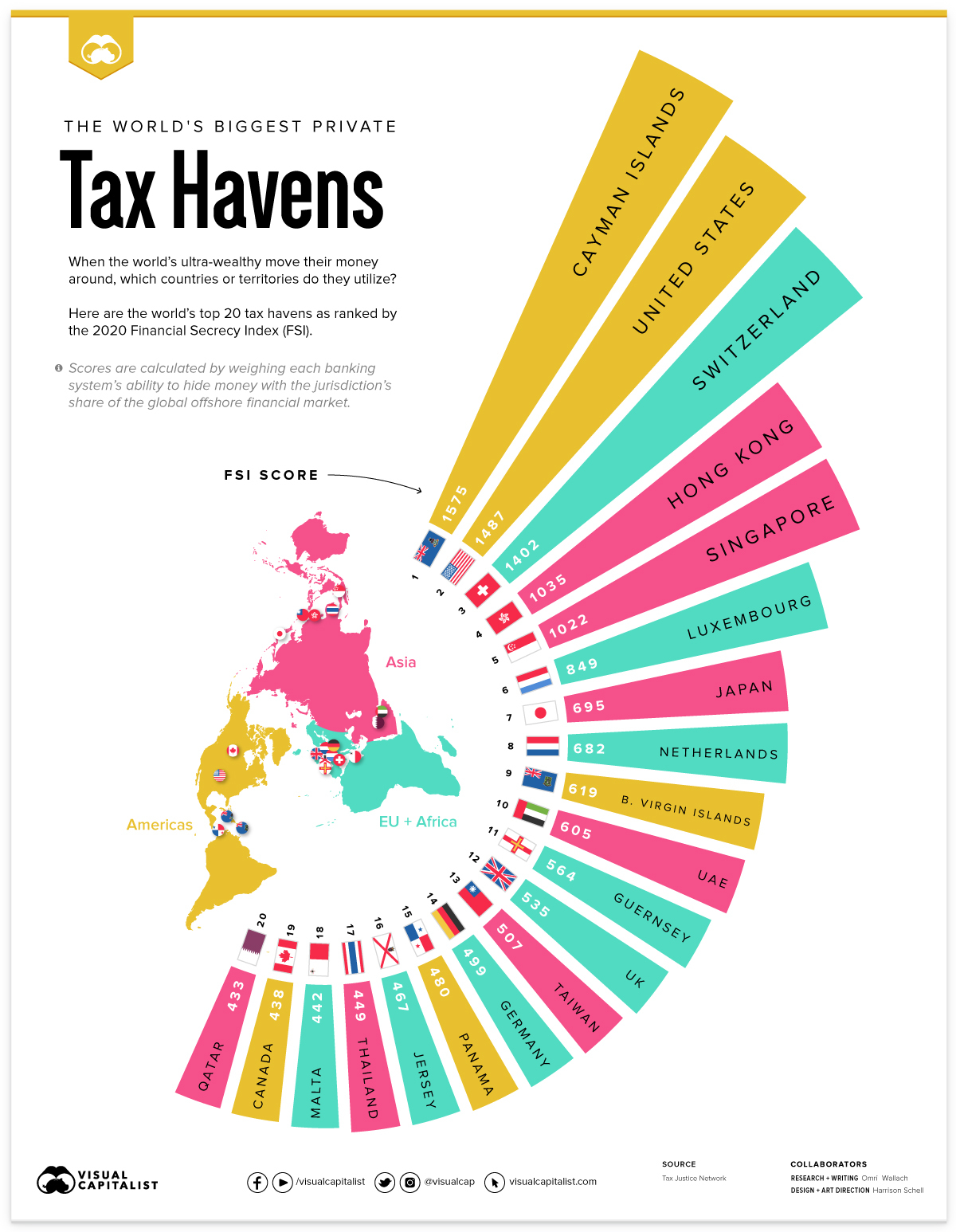

Mapped The World S Biggest Private Tax Havens In 2021

South Africa When Strong Institutions And Massive Inequalities Collide Carnegie Endowment For International Peace

How To Avoid Jail When You Owe Back Taxes

South Africa Resistance To Apartheid Britannica

Student Loan Forgiveness Is Taxed In These 13 States Bloomberg

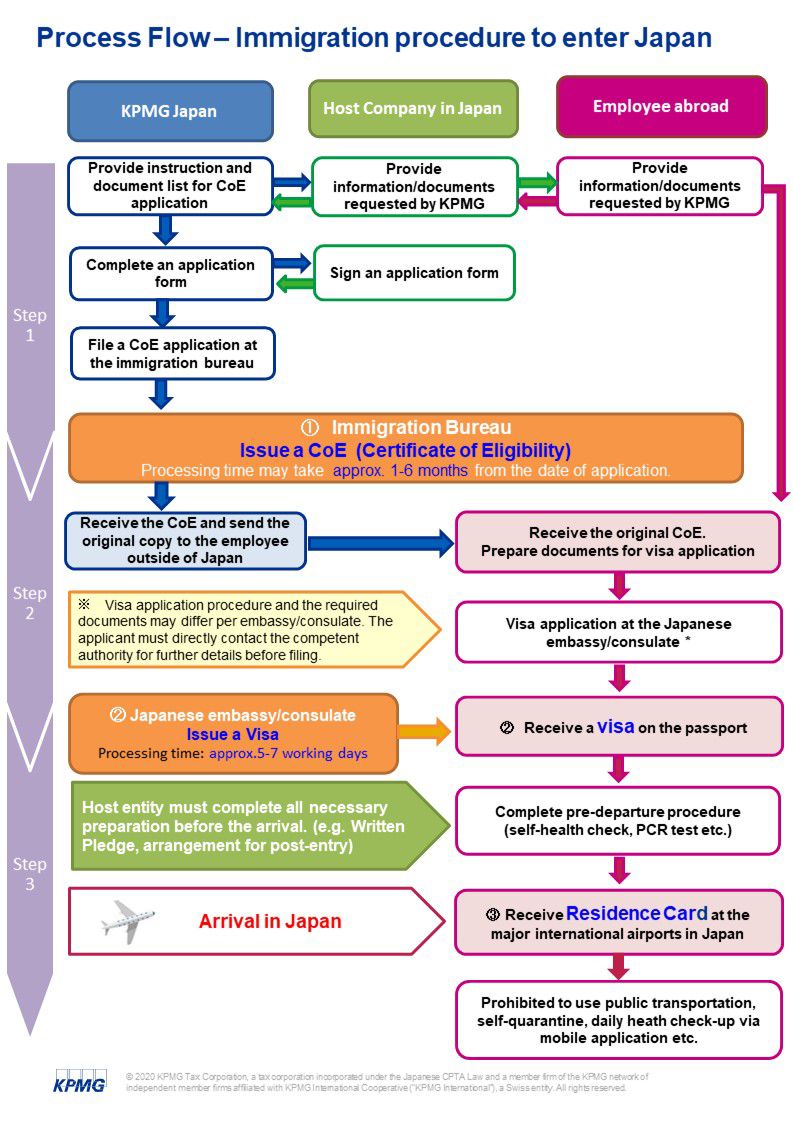

Japan Taxation Of International Executives Kpmg Global